Every May 22 bitcoin enthusiasts celebrate Bitcoin

Pizza Day. In 2010, back when hardly anyone had heard of bitcoin, Laszlo

Hanyecz used his

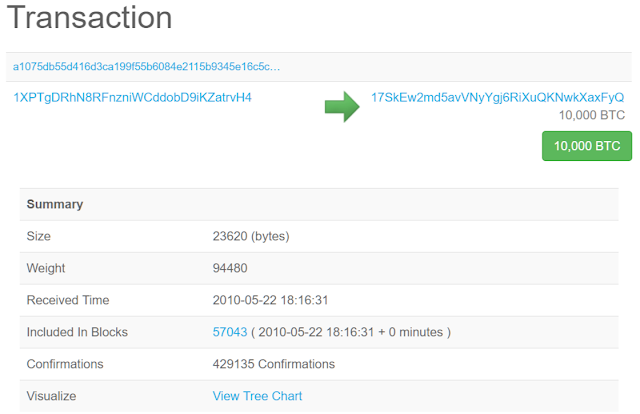

bitcoins to buy two Papa John's pizzas. Hanyecz sent 10,000 BTC to a fellow

BitcoinTalk forum user, jercos [sic], who bought the two pizzas from Papa John's using his credit

card and had them delivered to Hanyecz's house.

This Bitcoins-for-Pizzas transaction is often regarded as the

first real-world bitcoin transaction or purchase, the first transaction in which bitcoin was actually used

as a medium of exchange.

Wired wrote:

Laszlo Hanyecz, a Florida programmer, conducted what bitcoiners think of as the first real-world bitcoin transaction

This example of a trade of Bitcoins for a pizza is indirect exchange and therefore, from that time on, Bitcoin has been a medium of exchange.

The odd thing, however, is that even though bitcoin

is currently a medium of exchange and even though the Bitcoins-for-Pizzas transaction was an

example of indirect exchange, in the transaction bitcoin was not actually used

as the medium of exchange.

Forms of Exchange

Think about it. What normally happens in indirect

exchange is the following:

Mary wants to buy a pair of socks and has some apples to

sell. She sells the apples not directly for socks from Ali but for dollars

from Vijay. She then uses those dollars to buy the socks from Ali,

who in turn will use the dollars for whatever he wants to buy. So the dollars are the medium through which the exchange of apples for socks between Mary and Ali is facilitated.

Indirect Exchange

- Mary sends apples to Ali

- Ali sends dollars to Mary

- Mary sends dollars to Vijay

- Vijay sends socks to Mary

Direct Exchange

- Mary sends apples to Muhammed

- Muhammed sends socks to Mary

But in reality it is usually difficult, time-consuming, costly and unlikely to find somebody who:

- wants the exact things you want to sell

- sells the exact things you want to buy, and

- agrees with you on the exchange rate

So what you do instead is first sell your good for an intermediate good that is more liquid or saleable - a good that many people offer for sale and that many people want to buy - and then sell that intermediate good for the goods or services that you actually want.

But that's not what happened in the

case of the Bitcoins-for-Pizzas transaction.

Hanyecz wanted to buy two pizzas and

wanted to sell 10,000 bitcoins. Jercos wanted to sell $25 and buy 10,000

bitcoins. Papa John's had two pizzas they wanted to sell and $25 they wanted to

buy.

Bitcoins-for-Pizza Purchase

- Hanyecz sends bitcoin to jercos.

- Jercos sends dollars to Papa John's.

- Papa John's sends pizzas to Hanyecz.

In a standard instance of indirect

exchange there are three different goods that are moved from person to person for a

total of four times (see the four steps above), with the medium of exchange

being moved two times. With direct exchange there are only two goods that are

moved for a total of two times (see the two steps above). In the Bitcoins-for-Pizzas transaction on the other hand there are three goods that are moved a total of

three times (see the three steps above).

So the Bitcoins-for-Pizzas transaction was a

peculiar form of exchange that lies exactly in between the standard forms of

direct and indirect exchange, respectively. And in it, bitcoins were not used as

the medium for the exchange.

|

| The famous Bitcoins-for-Pizzas transaction |

Bitcoin's Unbearable Unsaleability

When you think about it, it makes

perfect sense that the Bitcoins-for-Pizzas transaction was not an example of indirect

exchange.

In indirect exchange a less saleable good is exchanged for a more saleable good in order to obtain a third good. A good is only sufficiently attractive as a medium of exchange if people are able to sell it whenever they want at 'economic prices', i.e. prices that correspond to the general economic situation.

In indirect exchange a less saleable good is exchanged for a more saleable good in order to obtain a third good. A good is only sufficiently attractive as a medium of exchange if people are able to sell it whenever they want at 'economic prices', i.e. prices that correspond to the general economic situation.

For a good to

be saleable at 'economic prices' there needs to be a considerable and

widespread demand for the good. After all, many goods are easily and almost

instantly saleable if you just lower their price enough, but for a

good to be attractive as a medium of exchange it needs to be easily saleable at regular

market prices instead of at drastically lowered prices.

If

you want to use something as a medium of exchange you don't want to have to buy

it (with the good that you sell) for a certain price but then only be able to

sell it (for the good that you want) for a much lower price. If that were to

happen your transaction costs, in the form of the depreciated value of the

medium of exchange, would be very high indeed.

But when we look at the state of

bitcoin in 2010, it is clear that back then bitcoins had exceedingly low saleability. Whereas billions of people accepted dollars as payment maybe only a

couple of dozen people accepted bitcoins. It would have been much easier for

Hanyecz to buy his pizzas with the dollars on his credit card. It is no surprise then that it took

a few days before somebody (jercos) took him up on his offer of 10,000 bitcoins

for two pizzas.

And if jercos had been looking to buy a medium of exchange that he could then use to purchase other goods surely he would not have exchanged a more

saleable good (his dollars) for a less saleable good (the bitcoins). Buying a less saleable good meant jecos had higher transaction costs and less purchasing power than he would have had if he'd bought a more saleable good (unless the bitcoins he bought were underpriced at the moment of purchase compared to other places he could have bought or earned bitcoins).

So his motivation to buy bitcoins cannot be explained by a desire to buy a medium of exchange. Some other factors - e.g. curiosity, coolness factor, ideology, speculating on price increases) - must have been at play.

---

---

One reason we may be tempted to view the

Bitcoins-for-Pizzas Purchase as an example of indirect exchange points to how far bitcoin has come in the past 7 years: Nowadays paying bitcoins to buy pizzas looks much more like a monetary transaction (e.g. paying

ten dollars for two pizzas) than like a barter transaction (e.g. paying a

basket of apples for two pizzas). But it does so only because we have come to view bitcoin more and more as a medium of exchange rather than as a mere commodity,

while that certainly was not the case back when this transaction took place in 2010.

BITCOIN CRYPTOCURRENCY INVESTMENT

ReplyDeleteInvestment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading the Crypto market has really been a life changer for me. I almost gave up on crypto currency at some point not until I got a proficient trader Bernie Doran, he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony, I invested $2000.00 and got back $20,500.00 within 5 days of investment. His strategies and signals are the best and I have gained more knowledge. If you are new to cryptocurrency. You can reach to him through Gmail : BERNIEDORANSIGNALS@GMAIL.COM or his WhatsApp : +1424(285)-0682

🇺🇸🇺🇸🇺🇸

📊📊📊

🇺🇸🇺🇸🇺🇸

Investing on the cryptocurrency market has been a main source of income, that's why knowledge plays a very important role in humanity, you don't need to over work yourself for money.All you need is the right information, and you could build your own wealth from the comfort of your home!Binary trading is dependent on timely signals, assets or controlled strategies which when mastered increases chance of winning up to 90%-100% with trading. It’s possible to earn $10,000 to $20,000 trading weekly-monthly in cryptocurrency(bitcoin) investment,just get in contact with Mr Bernie Doran my broker. I had almost given up on everything about binary trading and never getting my lost funds back, till i met with him, with his help and guidance now i have my lost funds back to my bank account, gained more profit and I can now trade successfully with his profitable strategies and software!!

ReplyDeleteReach out to him on Gmail (BERNIEDORANSIGNALS@GMAIL.COM) , or his WhatsApp : +1(424)285-0682 for inquiries🇺🇸🇺🇸🇺🇸

📊📊📊

🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸

📊📊📊

🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸

📊📊📊

🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸

📊📊📊

🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸

📊📊📊

🇺🇸🇺🇸🇺🇸